March 31, 2017

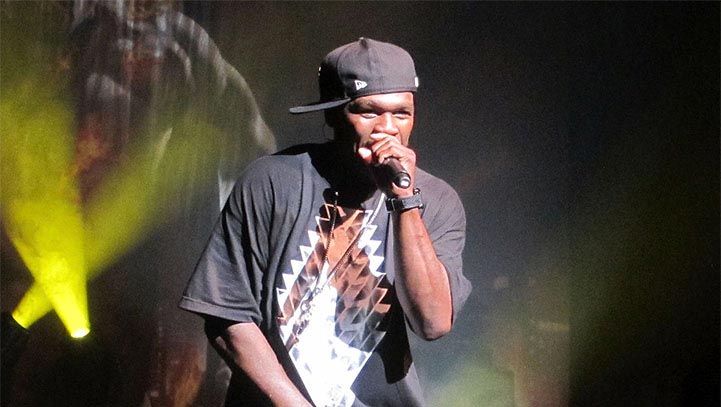

The rapper 50 Cent paid off more than $22 million , and a federal court discharged the bankruptcy in Hartford, Connecticut, in early February 2017. He originally filed bankruptcy in 2015, reporting assets of less than $20 with $36 million in debt. The court set a repayment plan in motion to the tune of about $23 million for the rapper, whose given name is Curtis James Jackson III.

Jackson broke into the rap scene in 2003 with the album, “Get Rich or Die Tryin.”

Jackson sought protection after several lawsuit rulings against him. He owns a mansion in Farmington. While the mansion was slated to be sold, the early repayment negated that necessity.

The original plan was scheduled to take five years, but he managed to repay it early by using his own money and more than $13.5 million that he received from a personal injury malpractice settlement. The courts allowed a discount for the early pay-off of the bankruptcy. He was able to initially pay $7.4 million followed by another $1.3 million. By negotiating with creditors after receiving the settlement, he was able to repay his debt early. Unsecured creditors dropped their claims from 74 to 72 percent.

However, his journey toward solvency was fraught with challenges, among them a debt of $6 million to a woman after he posted a sex tape of her with her boyfriend online. She originally requested $7 million but also agreed to a reduced settlement.

During the summer of 2015, when he initially filed for bankruptcy , he posted a photo of himself on social media with stacks of money. When the court questioned his behavior, his attorneys claimed that the money was not real and that he was simply pulling a publicity stunt, similar to the behavior of others in the entertainment industry.

Sleek Audio, the largest creditor, won $18.1 million but eventually received about $17.5 million. They had made a headphones deal with Jackson that eventually dissolved.

Filing bankruptcy might not result in the devastation that you believe. Talk to our legal team for further information on the types of bankruptcy and on possible options that might accelerate the process for you as well.